inheritance tax calculator colorado

In some states a person who receives an inheritance might have to pay a tax based on the amount he or she. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance tax.

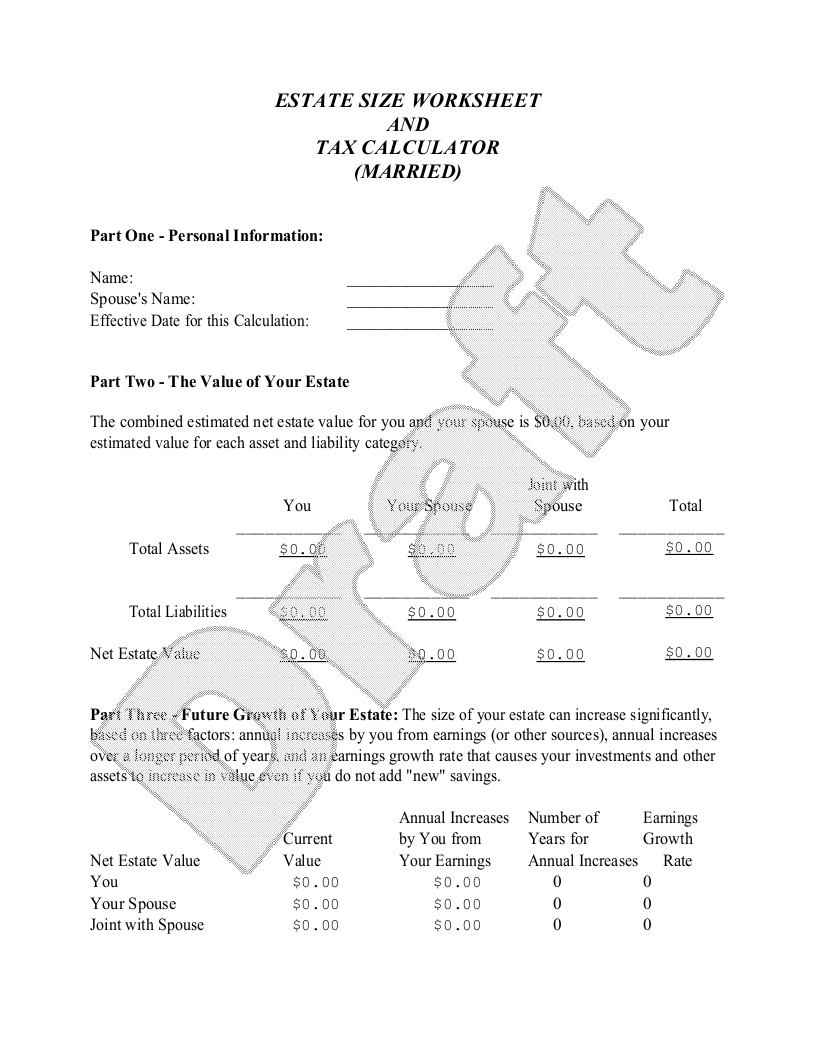

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

To calculate the Colorado income tax taxpayers calculate their state taxable income by adjusting their federal taxable income via state additions and subtractions.

. See How Easy It Is. Federal legislative changes reduced the state death. Until 2005 a tax credit.

Colorado does tax most types of capital gainsat the state income tax rate of 450 so its important to keep that in mind when selling any assets that arent part of a retirement account. Colorado Capital Gains Tax. Impose estate taxes and six impose inheritance taxes.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Colorado Inheritance Tax and Gift Tax. Calculate Your Retirement Taxes in These Other States.

No estate tax or inheritance tax connecticut. Spouses in Colorado Inheritance Law. From Fisher Investments 40 years managing money and helping thousands of families.

Difference between inheritance tax and estate tax. Surviving spouses are afforded incredibly strong inheritance rights to intestate estates according to Colorado inheritance laws. Joes tax rate is 10 on the inheritance so joe must pay 10000 on the money he.

Colorado also has no gift tax. Colorado inheritance taxes and estate taxes. It is sometimes referred to as a death tax Although states may impose their own estate taxes in the United States this calculator only estimates federal estate taxes Click here to check state-specific laws.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. It is a general guide not personal advice and does not cover every nuance of the. Most capital gains in Colorado are taxed at the standard income tax rate of 450.

Again Colorado is not one of the states. The calculator works out whether your estate may be subject to inheritance tax if you were to die today. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

Estimate the value of your estate and how much inheritance tax may be due when you die. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

In fact only six states have state-level inheritance tax Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45.

Inheritance taxes are taxes that apply directly to any property you receive as an inheritance. Federal legislative changes reduced the state death. However if you receive an inheritance of real property and that real estate is located in a.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Colorado inheritance laws are designed to dig up a relative who could inherit your property. In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere.

Twelve states and Washington DC. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. There is no estate or inheritance tax in Colorado. The good news is that Colorado does not have an inheritance tax.

Inheritance taxes are different. From 1980 until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit which is what the colorado estate tax was. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. The median property tax in colorado is 143700 per year for a home worth the median value of 23780000. There is no inheritance tax in Colorado.

Updated for the 2021-22 tax year. Make Your Money Work Then they multiply their state taxable income by the flat tax rate of 463 percent and subtract any state tax credits to get their net Colorado income tax or the amount they owe to the state. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 the colorado estate tax is based on this credit.

After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. The Centennial State does not have an estate taxor an inheritance tax.

Inheritance tax rates vary based on a beneficiarys relationship to the decedent and in some jurisdictions the amount inherited. If it does its up to that person to pay those taxes not the inheritors. An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

Maryland is the only state to impose both. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere.

Gains from property acquired after May 9 1994 which was held for at least five years before being sold may be exempt up to a limit of 100000. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. As a matter of fact theyre entitled to the whole of the estate if the decedent died without surviving children or parents or all of their children were solely with each other.

However certain long-term gains are exempt. The tax rate starts at 11 percent with four changes up to 16 percent. Estate tax is a tax on assets typically valued at the.

First estate taxes are only paid by the estate. Colorado requires that an individual survive a decedent by at least 120 hours or five days in order to become a valid heir under intestate succession law. Should you get so lucky the records of the property improvements you made may help lower your taxable gain.

There is no federal inheritance tax but there are a handful of states that impose state level inheritance taxes. A state inheritance tax was enacted in colorado in 1927. Federal legislative changes reduced the state death.

A state inheritance tax was enacted in Colorado in 1927.

2021 Capital Gains Tax Rates By State Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

Capital Gains Tax Calculator 2022 Casaplorer

States With Highest And Lowest Sales Tax Rates

Is Life Insurance Taxable Forbes Advisor

How To Calculate Sales Tax Video Lesson Transcript Study Com

How To Calculate Capital Gains Tax H R Block

Mortgage Calculator Canada Calculate Mortgage Payment Mortgage Payment Calculator Mortgage Payment Mortgage Amortization Calculator