florida estate tax exemption 2020

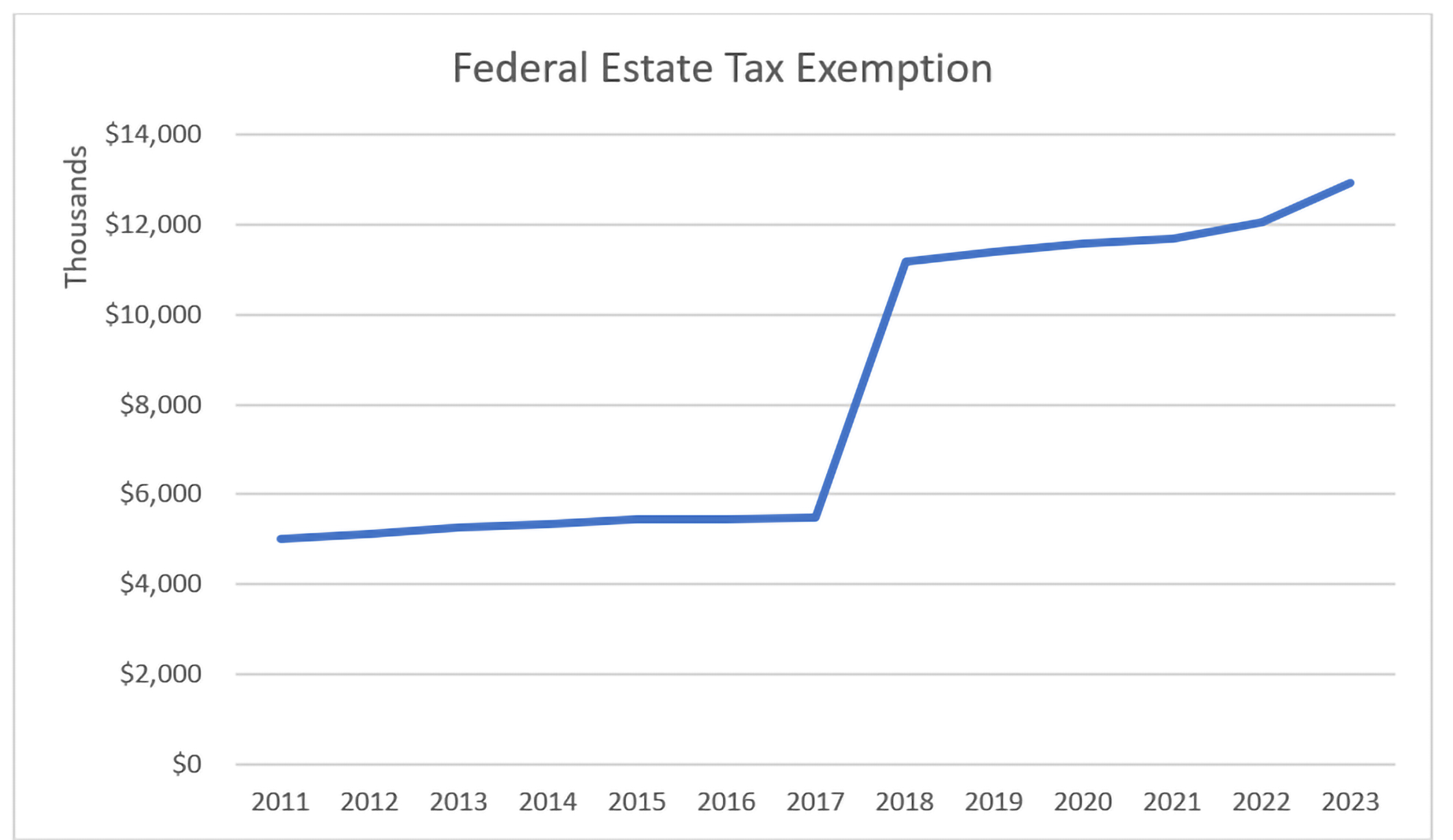

The 2021 exemption amount will be 117 million up from 1158 million for 2020. Property Tax Exemptions Available in Florida for People with Disabilities.

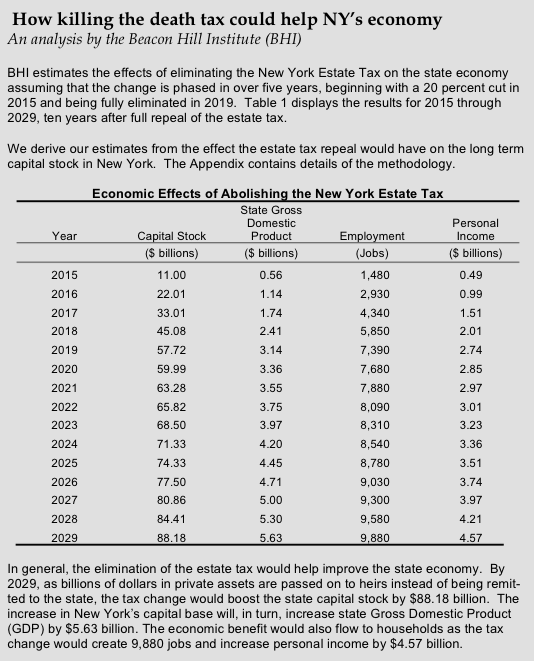

What Do I Need To Know About New York State Gift And Estate Taxes Russo Law Group

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

. 196031 Exemption of homesteads. 1 a A person who on January 1 has the legal title or beneficial title in equity to real property in this state and who in good faith makes the property. Estate Tax Exemption - 11580000 US.

The exemption amount will rise to 51 million in 2020 71 million in. Owns real estate and makes it his or her permanent residence Is age 65 or older. The federal government however imposes an estate tax that applies to all United.

How much can you inherit without paying taxes in 2020. How much can you inherit without paying taxes in 2020. Get information on how the estate tax may apply to your taxable estate at your death.

As mentioned florida does not have a separate inheritance death tax. Increased by the decedents adjusted taxable gifts and specific gift tax exemption is valued at more than. Real Property Dedicated in Perpetuity for Conservation Exemption Application sections 196011 and 19626 FS PDF 63 KB DR-504HA.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead. Florida Homestead Tax Exemption Case.

Citizens and Residents Annual Gift Tax Exemption - 15000 US. Citizens and Residents Gifts Between Spouses - Unlimited US. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million.

As mentioned florida does not have a separate inheritance death tax. If you have disabilities you may qualify for a 500 property tax deduction. For example if a person makes taxable gifts totalling 2 million during his lifetime he will have 97m estate tax exemption left over that may be passed at death 117m.

Federal Estate Taxes. Ad Valorem Tax Exemption Application and. Florida Homestead Tax Exemption Case.

As mentioned Florida does not have a separate inheritance death tax.

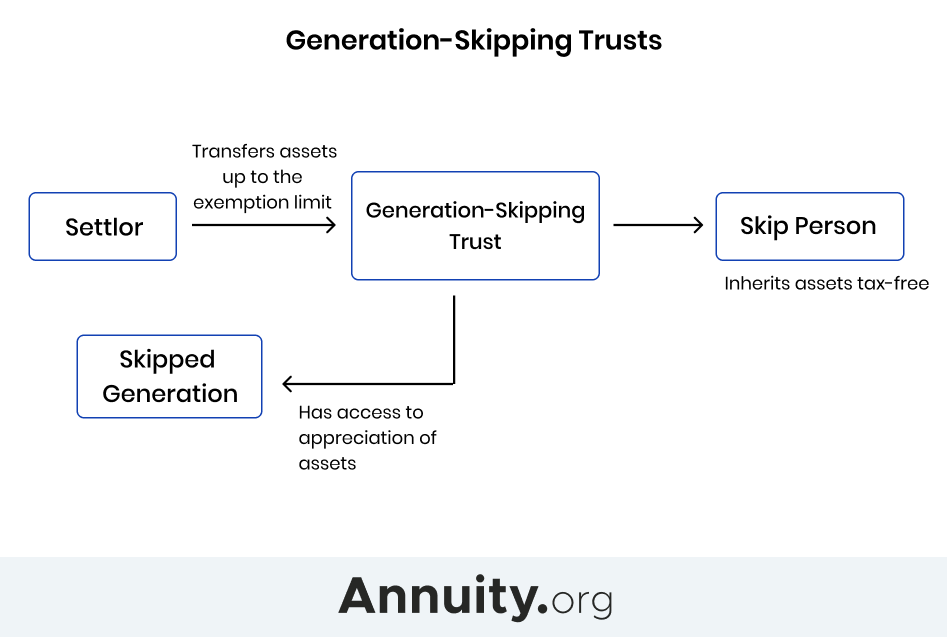

Generation Skipping Trust Gst What It Is And How It Works

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Tax Exemption For 2023 Kiplinger

House Democrats Propose Cutting Estate Tax Exemption Offer Higher Farmland Exclusion

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Mathing Out Estate Tax Planning Strategies

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Three Things I Learned From My Estate Planning Lawyer You Must Do

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

State Death Tax Hikes Loom Where Not To Die In 2021

Federal Estate Tax Portability The Pollock Firm Llc

Irs Guidance On Clawback Of Gift Estate Tax Exemption Cerity Partners